Financial Experts Reveal the Ultimate Car Budget

Are you ready to hit the road in a new set of wheels, but not sure how much you should spend? Let financial experts be your guide in determining the ultimate car budget that suits your needs and financial situation. In this article, we’ll break down the factors to consider, different options for buying a car, and provide valuable insights and tips to help you make an informed decision. Get ready to rev up your budget and make the best financial choice for your next ride.

Key Takeaways

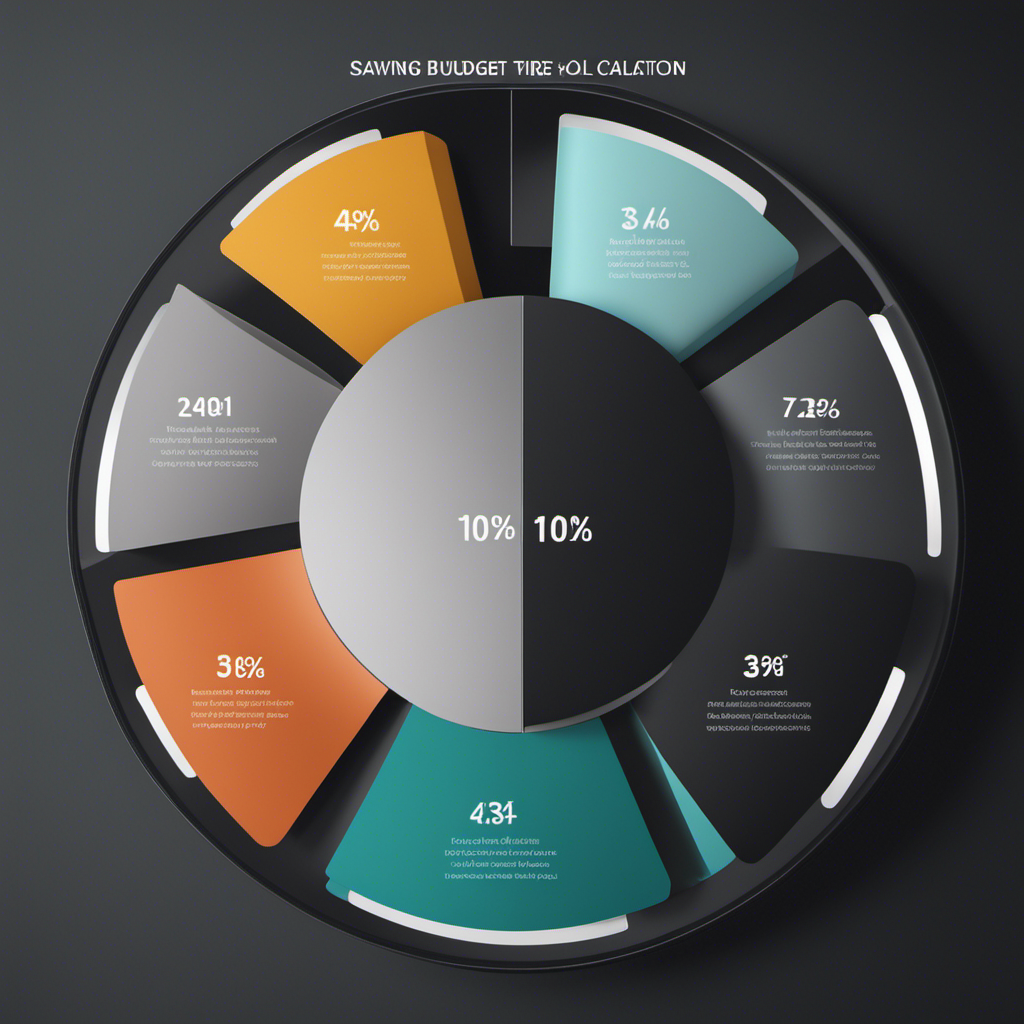

- Determine your car budget based on your income and financial situation.

- Consider allocating 10% of your income for a car if you want a more affordable option.

- Allocating 35% of your income towards a car is recommended as an average.

- Avoid allocating 50% of your income towards a car purchase to maintain financial stability.

Factors to Consider When Determining Your Car Budget

When determining your car budget, consider the factors that will impact your financial situation and needs. Calculating car affordability is essential to ensure you don’t overspend and put yourself in a difficult financial position. One crucial factor to consider is your credit score. Your credit score plays a significant role in car budgeting as it affects the interest rates you can get on a car loan. A higher credit score can result in lower interest rates, which can save you money in the long run. On the other hand, a lower credit score may lead to higher interest rates and potentially limit your car options. Therefore, it is important to prioritize improving your credit score before setting your car budget to secure better financing options.

Tiers for Car Budget Allocation: 10% of Income Tier

You should only allocate 10% of your annual income towards buying a new or used car in the 10% of Income Tier. This tier allows you to set aside a reasonable amount for a car without straining your finances. Here are some key points to consider:

-

Used car market trends: The price of used cars in 2022 has increased significantly due to the pandemic. This means that you may have to adjust your budget if you’re looking to buy a used car.

-

Pros and cons of leasing a car: Leasing a car can be a more affordable choice for those who want a new vehicle. It allows you to drive a brand-new car every few years and eliminates the need for costly repairs and maintenance. However, leasing also comes with limitations, such as mileage restrictions and the inability to customize the car.

-

Consider increasing your budget: If you can’t wait for a used car or if the prices are too high, you may need to consider increasing your car buying budget. This will give you more options and flexibility in the car market.

-

Paying cash may limit your options: In the 10% of Income Tier, paying cash may only get you a high-mileage used car that is less dependable. If you prefer a more reliable and newer car, you may need to explore financing options or increase your budget.

Remember to carefully evaluate your financial situation and consider these factors before making a decision.

Tiers for Car Budget Allocation: 35% of Income Tier

In the 35% of Income Tier, allocate a significant portion of your annual income towards buying a new or used car. This tier is considered the average recommendation by financial experts. For example, if you have a $30,000 annual income, you should spend around $10,500 in cash on a car. While this tier may require a more significant dent in your monthly budget, it can save you money in the long run. When considering your options, leasing a car can be a more affordable choice, as you don’t have to worry about costly repairs and maintenance. On the other hand, buying a new car has its pros and cons. While you have the advantage of owning a brand-new vehicle, you also have to deal with higher upfront costs and the potential for depreciation.

Tiers for Car Budget Allocation: 50% of Income Tier (Not Recommended)

Paying 50% of your yearly income towards a car purchase is not recommended, as it can wreck your personal finance and monthly budget. While it may seem tempting to splurge on a car with a higher budget, it’s important to consider the potential drawbacks. Here are some factors to keep in mind:

-

Pros and Cons of Leasing a Car: Leasing a car can be a more affordable choice for those who want a new vehicle. It allows you to drive a brand-new car every few years without worrying about costly repairs and maintenance. However, keep in mind that you won’t own the car at the end of the lease, and there may be mileage restrictions or penalties for excessive wear and tear.

-

Benefits of Buying a Used Car: Buying a used car can be a more cost-effective option, especially if you’re on a tighter budget. You can find used cars at great prices that are still under warranty, saving you money on expensive repairs and maintenance. However, it’s important to thoroughly inspect any used car before purchasing to avoid buying one that will break down quickly.

Considering these factors, it’s advisable to explore other car budget tiers that offer more financial stability and flexibility.

Determining Affordability and Setting a Budget

Before embarking on your car shopping journey, it is important to determine your affordability and set a budget. Start by understanding your current income, debts, and credit score. Use a budget tool to organize your personal finances and see your financial situation at a glance. Aim to keep your debts below 36% of your income to afford a new car loan. Once you have a clear understanding of your financial situation, set a target price range for the car, including sales tax and fees. Calculate estimated loan payments and use an auto loan calculator to determine your monthly payment and down payment. Evaluating the impact of car expenses on your overall budget will help ensure that you can comfortably afford the car and avoid any financial strain.

Different Options for Buying a Car

Consider leasing a car instead of buying one to save money. Here are some options to consider when buying a car:

-

Benefits of leasing a car:

-

Leasing allows you to drive a brand-new vehicle every few years.

-

You don’t have to worry about costly repairs and maintenance.

-

You can often get a lower monthly payment compared to buying a new car.

-

Leasing is ideal if you can return the car with minimal damage at the end of the lease.

-

Pros and cons of buying a used car:

-

Used cars can be a more affordable option for those on a tighter budget.

-

You can find used cars at great prices that are still under warranty.

-

Thoroughly inspect any used car to avoid buying one that will break down quickly.

-

Buying a used car can save you money on costly repairs and maintenance.

Consider these options and weigh the benefits and drawbacks to make the best decision for your car purchase.

Frequently Asked Questions

How Do I Determine the Best Car Budget for My Needs and Financial Situation?

To determine the best car budget for your needs and financial situation, consider your income, debts, and credit score. Use a budget tool to organize your finances and set a target price range. Calculate loan payments and explore different options like buying used or leasing.

What Are Some Factors to Consider When Determining the Affordability of a New Car Loan?

When determining the affordability of a new car loan, consider interest rates and your credit score. Calculate your car budget based on monthly expenses and future financial goals.

Can I Negotiate the Price of a Used Car to Fit Within My Budget?

Yes, you can negotiate the price of a used car to fit within your budget. Use effective negotiating strategies and consider managing car financing options to ensure you get the best deal.

Are There Any Additional Costs or Fees Associated With Buying a Car That I Should Be Aware Of?

When buying a car, there are additional costs and hidden fees you should be aware of. These can include documentation fees, title transfer fees, license plates and registration fees, and sales tax on the purchase price.

What Are Some Tips for Saving Money on Car Expenses, Such as Insurance and Maintenance?

To save money on car expenses, try these tips: shop around for insurance quotes, maintain a good driving record, and consider raising deductibles. For maintenance costs, perform regular maintenance, compare prices at different shops, and learn basic DIY skills.

Conclusion

Congratulations! You’ve now gained valuable insights into setting the ultimate car budget that suits your needs and financial situation. By considering factors like income tiers and affordability, you can make an informed decision that aligns with your financial goals. Remember to explore the various options for buying a car, such as used cars, leasing, or purchasing a brand-new vehicle. By following these tips and strategies, you’ll be on your way to making the best financial choice for your next car. Happy car shopping!